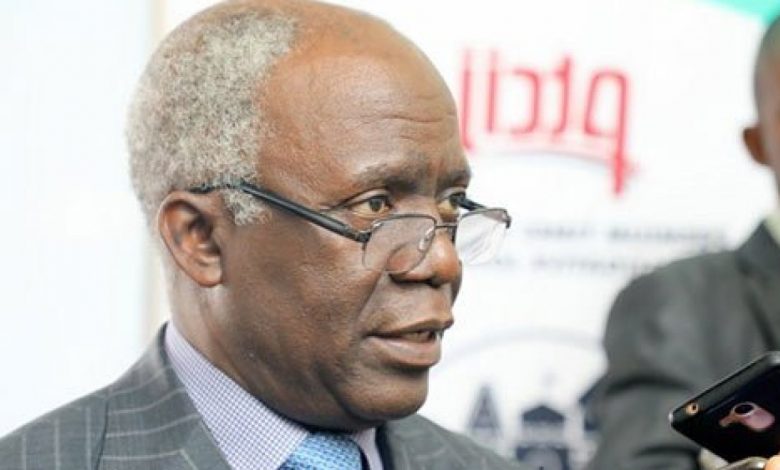

The Alliance on Surviving Covid-19 and Beyond (ASCAB), led by prominent human rights lawyer Femi Falana (SAN), has called for an immediate investigation into the potential misappropriation of Nigeria’s $3.4 billion COVID-19 relief loan provided by the International Monetary Fund (IMF). The loan, which was granted to Nigeria in 2020 under the IMF’s Rapid Financing Instrument (RFI), was intended to help the country stabilize its healthcare system and mitigate economic losses caused by the pandemic and the global oil price crash.

Falana, speaking on behalf of ASCAB, noted that the IMF recently confirmed Nigeria had fully repaid the loan, but additional fees and charges have yet to be settled. According to current figures, the IMF is seeking an additional SDR 125.99 million (approximately N275.28 billion) in charges, including interest and administrative fees. These developments have raised questions about the proper use of the funds, especially following the findings of an audit report released by the Office of the Auditor-General of the Federation.

The loan was approved by the IMF’s Executive Board in April 2020, with strict stipulations for transparency and accountability regarding how the funds were to be spent. In a statement at the time, Mitsuhiro Furusawa, the IMF’s Deputy Managing Director, underscored the necessity of proper governance mechanisms, which included independent audits and the publication of spending details. These measures were put in place to ensure the funds were used for their intended purpose of alleviating the immediate impacts of the pandemic.

However, an audit report from January 2024 has raised serious concerns. The report revealed that, shortly after the loan’s disbursement, significant irregularities occurred. It was found that $2.4 billion of the loan was transferred to the Central Bank of Nigeria (CBN) account at the Federal Reserve Bank in New York, with another portion moved to the Bank of China in Shanghai. These transfers were not supported by documentation from either the Nigerian government or the CBN’s Investment Committee, which is required for such transactions.

Furthermore, the audit showed that by June 2020, the transferred funds were moved into short-term investments, contrary to the intended purpose of the loan. These funds were later reclassified as part of the CBN’s external reserves, generating interest in the process, which was not in line with the emergency relief guidelines set by the IMF.

The audit report also uncovered a troubling transaction in August 2020, when the Federal Ministry of Finance requested the monetization of $700 million to support the federal budget. The CBN, using an exchange rate that differed from the official rate, moved funds into various accounts, including the COVID-19 Public Sector Account and the Forex Equalisation Account. Additionally, a 2% commission was deducted from the monetized funds, despite the loan being classified as federal government property.

The audit further revealed that an unmonetized balance of $2.7 billion remains unaccounted for. The report has called on the CBN Governor to explain the unauthorized movement and reclassification of the funds, as well as the recovery of certain amounts from misallocated accounts.

Despite the gravity of these findings, there has been little action from the National Assembly, raising concerns that the matter is being overlooked. ASCAB, in its statement, has condemned this lack of response, suggesting that it points to a potential cover-up of the alleged mismanagement and misappropriation of the loan.

In light of these revelations, ASCAB has called on both the Economic and Financial Crimes Commission (EFCC) and the Independent Corrupt Practices and Other Related Offences Commission (ICPC) to launch a thorough investigation into the alleged criminal diversion of the loan funds. The organization has also urged the IMF Board to suspend the collection of the additional charges until a full investigation is conducted.

“We call on the IMF Board to probe the deliberate refusal of its Management to ensure that the emergency funds were used for their intended purposes,” the statement read.