The Economic and Financial Crimes Commission (EFCC) has declared two more individuals wanted for their alleged roles in the Crypto Bridge Exchange (CBEX) fraud, a digital investment scheme that crashed earlier this year. The anti-corruption body made this known in a statement released on Wednesday, June 4, 2025, through its official social media channels.

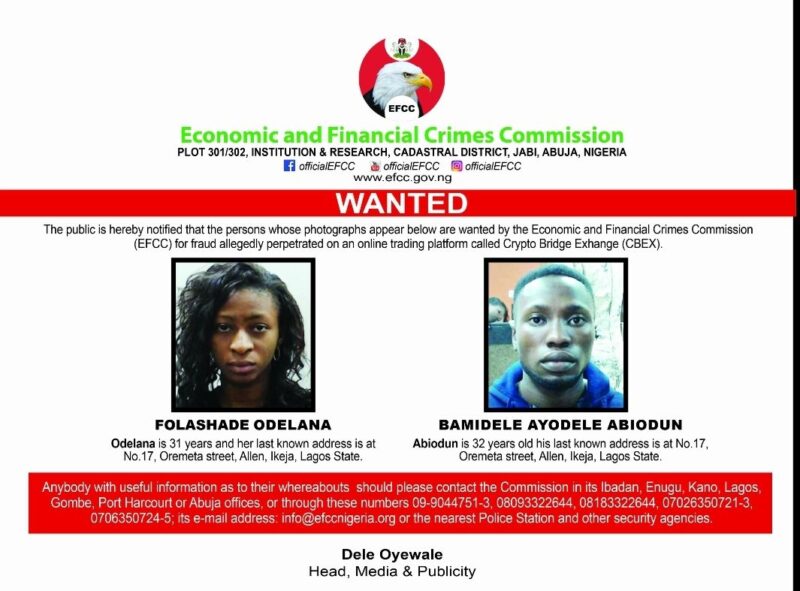

According to the EFCC, the two newly declared suspects are Folashade Odelana, aged 31, and Bamidele Ayodele Abiodun, aged 32. Both are believed to have played key roles in the operations of the platform, which is accused of swindling hundreds of thousands of Nigerians through false investment promises.

The Commission noted that both suspects shared the same last known address—No. 17, Oremeta Street, Allen, Ikeja, Lagos. Authorities say the pair disappeared shortly before the scheme collapsed in April 2025, leaving behind a trail of financial ruin. Reports indicate that over 600,000 people invested in the platform, with combined losses reaching up to ₦1.3 trillion.

In its public notice, the EFCC called on Nigerians to assist in locating the suspects. “The public is hereby notified that the persons whose photographs appear below are wanted by the Economic and Financial Crimes Commission (EFCC) for fraud allegedly perpetrated on an online trading platform called Crypto Bridge Exchange (CBEX),” the Commission stated.

The EFCC also provided contact details for members of the public willing to share helpful information, including multiple phone numbers, an email address (info@efccnigeria.org), and instructions to reach out to any EFCC office or the nearest police station.

So far, a total of 12 individuals have been declared wanted in connection to the CBEX case. Investigations continue as the Commission works to trace the whereabouts of all those involved and recover funds from the massive fraud.

The CBEX platform, once promoted as a legitimate online trading opportunity, reportedly used social media influencers and flashy marketing to lure in investors. Many victims claimed they were promised quick returns and assured of the platform’s credibility—until it abruptly went offline in April.