President Bola Tinubu has officially approved the implementation of a zero percent import duty and an exemption from value-added tax (VAT) on essential food items. This significant move is part of the government’s efforts to tackle the rising cost of food in Nigeria.

The approval was communicated through a letter from the Ministry of Finance, addressed to the Nigeria Customs Service (NCS). The letter, signed by the Minister of Finance, Wale Edun, outlines the conditions and limitations of this measure, stating that it is aimed at reducing the high prices of food items across the nation.

According to Edun, the waiver will only apply to the national supply gap, which will be determined by a special committee set up by the Minister. This means that only a certain quantity of food items that are in short supply will benefit from the waiver. Additionally, the waiver will be granted exclusively to importers who have milling capacity and a verifiable Backward Integration Programme (BIP), a strategy that encourages the use of locally sourced raw materials to decrease reliance on imports.

“The importation of these items shall also be limited to investors with milling capacity and verifiable Backward Integration Programme (BIP) for some of the items,” Edun stated in the letter.

He further mentioned that during the waiver’s implementation period, the Ministry will regularly provide Customs with an updated list of approved importers and their quotas, ensuring that the process is transparent and well-regulated. The Nigeria Customs Service has been instructed to ensure strict adherence to these guidelines.

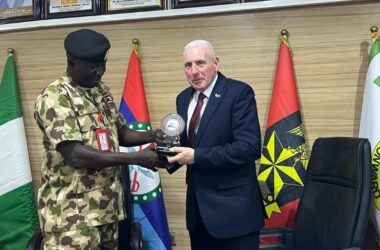

On Tuesday, the Comptroller-General of the Nigeria Customs Service, Bashir Adeniyi, revealed that the federal government stands to lose approximately N188 billion in revenue due to this suspension of import duties on food commodities. However, Adeniyi assured that the Customs Service would implement the waiver efficiently by creating special corridors for the clearance of these essential food items.