President Bola Tinubu has signed four important tax reform bills into law, focusing on reshaping Nigeria’s fiscal and revenue systems.

The signing event took place at the Aso Rock Presidential Villa in Abuja around 3:20 pm on Thursday.

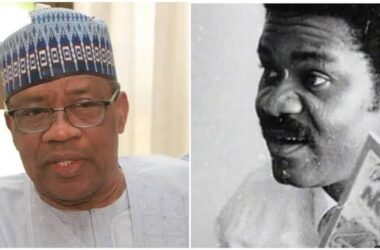

Present at the ceremony were top government officials, including the Senate President, the Speaker of the House of Representatives, and other key leaders from both the National Assembly and state governments.

The four new laws include:

- Nigeria Tax Bill

- Nigeria Tax Administration Bill

- Nigeria Revenue Service (Establishment) Bill

- Joint Revenue Board (Establishment) Bill

These bills were passed after months of discussions and input from stakeholders across the country. They are expected to bring big changes to how tax is managed in Nigeria.

According to a statement from presidential spokesperson Bayo Onanuga, “When the new tax laws become operational, they are expected to significantly transform tax administration in the country, leading to increased revenue generation, improved business environment, and a boost in domestic and foreign investments.”

One of the laws, the Nigeria Tax Bill (Ease of Doing Business), aims to bring different tax rules into one simple law. The goal is to reduce the number of taxes people and businesses must deal with. This is expected to make it easier to do business in Nigeria and give taxpayers more clarity.

The Nigeria Tax Administration Bill will create a standard legal structure for handling taxes at all levels of government—federal, state, and local. It will make tax collection more organized and fair.

Another major law, the Nigeria Revenue Service (Establishment) Bill, will replace the old Federal Inland Revenue Service Act. It introduces a new national revenue agency, the Nigeria Revenue Service, which will now handle both tax and non-tax revenue. It also sets new rules for better transparency and stronger performance.

The final law signed is the Joint Revenue Board (Establishment) Bill. It brings together federal and state tax offices under one framework, allowing them to work more closely. It also creates new systems for resolving tax issues, such as the Tax Appeal Tribunal and the Office of the Tax Ombudsman.

Also in attendance were Kwara State Governor Abdulrahman Abdulrazaq, Imo State Governor Hope Uzodinma, Finance Minister Wale Edun, and Attorney General Lateef Fagbemi.