The Federal Government and the World Bank have entered a new partnership aimed at reducing poverty and improving living conditions for millions of Nigerians. The initiative will see the release of $17 billion in funding, channelled into various social investment programmes designed to help the most vulnerable in the country.

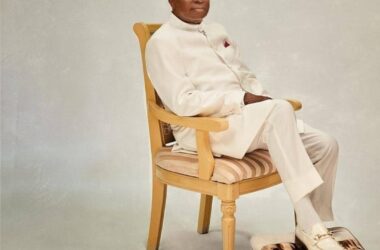

During a meeting held in Abuja, the World Bank’s Regional Vice President for Western and Central Africa, Ousmane Diagana, met with Nigeria’s Minister of Humanitarian Affairs and Poverty Reduction, Prof. Yilwatda Nentawe, along with the Minister of State, Dr. Yusuf Sununu. At the event, Diagana confirmed the World Bank’s commitment to the programme.

“This partnership of the World Bank is anchored in a strategy that allows Nigeria to continue to make progress as a developing country by providing quality services to the people through job creation and others,” Diagana said.

He also stated that the World Bank’s involvement in Nigeria includes a broad investment plan, totalling over $17 billion, which covers both financial support and reforms targeted at long-term development.

Minister Nentawe also revealed that beneficiaries of the Federal Government’s Conditional Cash Transfer programme will now be issued digital identities. According to him, this new approach will help trace and monitor beneficiaries more efficiently.

“This digital identity offers not just social inclusion but also financial inclusion to hundreds of thousands of Nigerians who, before now, were not socially inclusive and were also not financially included in Nigeria,” he said.

Meanwhile, the Independent Media and Policy Initiative (IMPI) pushed back against recent comments made by former Senate Chief Whip, Mohammed Ndume, who questioned the transparency and purpose of World Bank loans taken under President Tinubu’s leadership.

In a statement signed by its Chairman, Dr. Omoniyi Akinsiju, IMPI noted that Ndume’s comments lacked depth and did not reflect the realities of Nigeria’s borrowing strategy. “Our analysis shows that World Bank loans accounted for nearly 80 per cent of Nigeria’s multilateral debt in 2024, rising modestly from $21.15 billion in 2023 to $22.32 billion in 2024, a 5.5 per cent increase, not the $9.5 billion figure Ndume cited.”

IMPI also addressed concerns about whether proper legislative steps were followed. “The World Bank credit approval process requires approval by its internal arms (IDA or IBRD) and subsequent concurrence by the National Assembly before disbursement. For the record, the World Bank approved six projects (valued at $4.25 billion) for Nigeria in 2024, but actual disbursements between 2023 and 2024 stand at just $2.36 billion, far from the $9.5 billion claimed.”

The policy group noted that data over the past 22 months showed a deliberate and careful borrowing pattern, not reckless accumulation of debt.