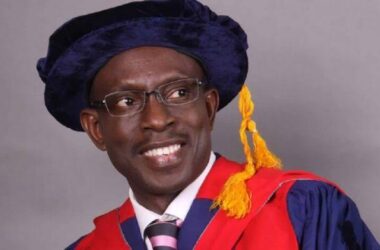

The Federal Government has announced the exemption of 63 specific items from Value-Added Tax (VAT). This move, part of a broader effort to reduce the financial burden on businesses and consumers, was confirmed by Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, in a statement shared on social media platform X on Friday, October 5, 2024.

The VAT exemption falls under the ‘Value Added Tax (Modification) Order, 2024,’ which was officially dated September 3, 2024. These measures are part of fiscal reforms designed to improve economic activities in various industries, especially energy, technology, and manufacturing, and are effective from October 1, 2024. The exemption specifically targets industries related to clean energy, liquefied natural gas (LNG), and compressed natural gas (CNG), among others.

The recent policy also coincides with broader economic reforms within Nigeria’s oil and gas industry. Earlier this week, Wale Edun, the Minister of Finance and Coordinating Minister of the Economy, emphasized the government’s dedication to revitalizing the oil and gas sector as a key strategy for economic recovery. The VAT exemption aligns with this goal by encouraging investments in renewable energy and cleaner fuel alternatives, which are seen as critical to Nigeria’s energy future.

In the official gazette, effective from October 1, 2023, the exempted items include:

– CNG/LPG Dual Fuel Vehicles

– Dedicated LPG Vehicles and CNG/LPG Dual Fuel Vehicles

– Parts, and semi-knocked down units (for assembly) of CNG and LPG buses.

– Parts, and semi-knocked down units (for assembly) of Electric Vehicle

– Electric Vehicles

– Electric Vehicles Battery

– Electric Vehicles Charging System

– Electric Vehicle Solar Charging System

– LPG/CNG Conversion Kits

– CNG Cylinders

– CNG Cascades

– CNG Dispensers

– Gas Generators

– CNG Trucks (Bobtails and Bridgers; fixed axle and semi-trailers

– Steel Pipes

– Steel Valves & Fittings

– SS Tubes & Fittings

– Storage Tanks (all sizes)

– Regulators

– CNG Pumps and Compressors (all types)

– Steel

– Pressure Relief Valves

– Hydraulic press/Rolling machine

– Heat Treatment Equipment

– Liquid Level Guage

– Pumping Housing and Motors

– Regulator Body

– Pressure Guage

– Truck Chassis

– Metering and Measuring Equipment (including weighbridges, and filling scales)

– Dispensing equipment (dispensing scales, nozzles, gas filling systems)

– Safety Features (emergency shutoff valves, pressure relief valves, excess flow valves, breakaway couplings, quick release couplings)

– Gas water heaters

– Gas burners for industry

– Gas boilers

– Gas washing machines and dryers (launderettes) Household or laundry-type washing machines, including machines which both wash and dry.

– CNG, LPG and Cyrogenic Hoses Tubes, pipes and hoses, and fittings thereof (for example, joints, elbows, flanges) of plastics.

– CNG truck heads

– Gas Leak Detectors

– Gas air conditioners

– Cylinder refurbishment equipment

– Blending skid/unit

– Odourizing unit

– Chromatography unit (GC)

– LNG Liquefying Equipment, Heat Exchangers, LNG Vapourizers, Regasification

– Plant, Liquefied CNG Compression Terminals

– LNG Plant, Machinery, Pumps, Compressors, Filters (Including Gas Filters),

– Weighing Machines, Valves Equipment

– Cyrogenic Storage Tanks, Liquefied CNG Conversion tanks

– Pipes, Piping Fittings, and Flanges used for Liquefied Natural Gas processing

– Electrical Equipment, including Cables for Liquefied Natural Gas processing

– Steel Plates, Angles, and Bars for Liquefied Natural Gas Processing

– LNG Related Chemicals

– Biogas Digester

– Biogas Compressor

– De-sulphurization units

– Dryer

– Distillation columns for processing biofuels

– Bio-ethanol refinery equipment

– Fermentation Tanks

– Biofuel-related Chemicals, Enzymes and Reagents

– Liquefied Petroleum Gas

– Compressed Natural Gas

– Feed Gas

– Automotive gas oil