President Bola Tinubu will, on Thursday, sign into law four new tax bills designed to reshape Nigeria’s tax and revenue management system, the Presidency has announced.

According to a statement released Wednesday by Bayo Onanuga, Special Adviser to the President on Information and Strategy, the new tax bills will be signed at the Presidential Villa in Abuja. The signing ceremony will include top government officials and leaders from both the executive and legislative arms of government.

The bills to be signed into law are the Nigeria Tax Bill, the Nigeria Tax Administration Bill, the Nigeria Revenue Service (Establishment) Bill, and the Joint Revenue Board (Establishment) Bill.

These bills were passed by the National Assembly following months of discussions with major stakeholders and groups with interests in Nigeria’s fiscal future.

Onanuga noted that the new legislation will bring major changes to how taxes are managed in the country.

He said, “When the new tax laws become operational, they are expected to significantly transform tax administration in the country, leading to increased revenue generation, improved business environment, and a boost in domestic and foreign investments.”

Several high-ranking officials are expected to attend the signing event. These include Senate President Godswill Akpabio, Speaker of the House of Representatives Tajudeen Abbas, Senate Leader Opeyemi Bamidele, House Majority Leader Julius Ihonvbere, and finance committee chairmen Sani Musa and James Faleke.

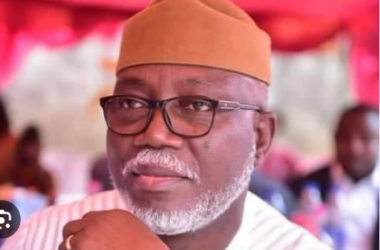

Also expected are Abdulrahman Abdulrazaq, Chairman of the Nigeria Governors Forum; Hope Uzodinma, who leads the Progressives Governors Forum; Minister of Finance Wale Edun; and Attorney General Lateef Fagbemi.

One of the four bills, the Nigeria Tax Bill (Ease of Doing Business), seeks to streamline Nigeria’s tax laws into one single document. The goal is to remove multiple tax layers and make compliance easier for businesses, creating a more predictable environment for investors.

The Nigeria Tax Administration Bill focuses on setting a clear and unified structure for tax operations at all levels—federal, state, and local. This is expected to reduce confusion and ensure better coordination across the government.

The third bill, the Nigeria Revenue Service (Establishment) Bill, repeals the Federal Inland Revenue Service Act. It introduces a new agency called the Nigeria Revenue Service (NRS), which will have broader powers, including handling non-tax revenues. The new body is designed to work with more independence and deliver better performance in revenue collection.

Lastly, the Joint Revenue Board (Establishment) Bill creates a formal platform for tax agencies at all levels to work together. It will also introduce new bodies like a Tax Appeal Tribunal and a Tax Ombudsman’s Office to address taxpayer concerns and improve transparency.